Note: You can send free and instant transfers to other Aspire accounts. Please check your eligibility here.

Admin and Finance users with transfer rights can send international transfers via two methods:

Local Transfer

Admin and Finance users with transfer rights can send supported currencies locally to the recipient's local bank account (e.g., Australian or Canadian local bank accounts) for free.

Refer to the table below for supported currencies and transfer limits for local transfers from the Aspire USD account:

Currency | Home Country | Maximum Amount per Local Transfer |

AUD | Australia | No limit |

CAD | Canada | 100K CAD |

CZK | Czech Republic | 1M CZK |

DKK | Denmark | No Limit |

EUR | No Limit | |

GBP | United Kingdom | 100k GBP |

HKD | Hong Kong | 500K HKD |

HUF | Hungary | 10M HUF |

IDR | Indonesia | 350M IDR |

INR* | India | 1.5M INR per beneficiary per day |

MXN | Mexico | No Limit |

MYR | Malaysia | 100K MYR |

NOK | Norway | 25M NOK |

PHP | Philippines | 1.3M PHP |

PLN | Poland | 150K PLN |

RON | Romania | 200K RON |

SEK | Sweden | No Limit |

USD | United States | 1M USD |

SGD | Singapore | 200K SGD |

SWIFT Transfer

If a country is not listed in the local transfer table above, you can send a SWIFT transfer using the supported currencies below:

Supported Currencies for SWIFT Transfers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supported Countries for SWIFT Transfers

SWIFT transfers are available in most countries. If a country is not listed in the "Unsupported Countries" section below, then it is supported.

Unsupported Countries for SWIFT Transfers

Afghanistan | Lebanon |

Belarus | Libya |

Burundi | Myanmar |

Cambodia | North Korea |

Central African Republic | Palestine |

Crimea | Russia |

Cuba | Somalia |

D.R.C | South Sudan |

Eritrea | Sudan |

Guinea Bissau | Syria |

Iran | Ukraine |

Iraq | Venezuela |

Kazakhstan | Yemen |

Laos | Zimbabwe |

To view the latest updates on restricted countries, please refer to the links below:

Making a transfer

1. Go to your USD Account, click on "Make a transfer"

2. Choose “Pay a recipient” then click on "New Recipient"

3. Select the currency you wish to send, then place the account holder name*, country and recipient type

Notes:

To ensure a smooth transfer, we recommend confirming the exact name format with your beneficiary. Although omitting special characters in the Account Holder's name typically works, there is a slight possibility that the beneficiary's bank may reject the transfer due to a name discrepancy. Verifying this information in advance can help prevent any potential issues.

At the moment, Chinese characters are not supported for beneficiary names when making transfers from an Aspire USD account. As an alternative, you may consider using Aspire’s FX partner for your transfer. However, please note that our FX partner can only accommodate transfers using Chinese characters in CNH to China for general goods trading purposes.

4. Select "SWIFT" tab to send SWIFT transfers. To send a local transfer*, be sure to select the "Local Bank Account" tab.

Note: Only selected currencies can be sent locally.

5. Enter the recipient's bank details and proceed by clicking the "Continue" button

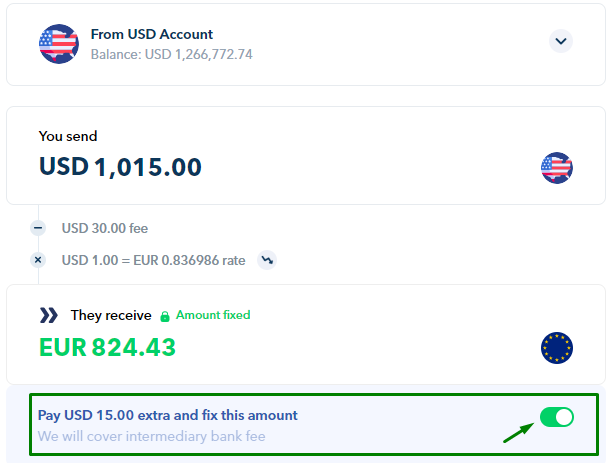

6. Enter the amount you wish to send.

To guarantee that the recipient receives the full amount, you can cover the intermediary SWIFT Fee, which costs USD 30, by clicking the pen button next to the Intermediary fee field. Choose “Cover intermediary fee (OUR)” then hit “Save”

When sending an FX transfer (except SGD, EUR or GBP transfers), a pop-up box will appear to ask you to confirm the amount you would like to fix in case the exchange rate changes before transfer approval

When initiating SGD, EUR or GBP transfers from your USD Account that require approval, you can set a guaranteed exchange rate for 3, 4, 12 or 24 hours. Just click on button right next to the “Rate guarantee” field to set your preferred period.

Notes:

For 12 and 24-hour periods, a non-refundable fee is charged immediately upon submission to hold the rate.

If the transfer isn't approved during the rate guarantee period, you can proceed at the current exchange rate.

There is a 2% rate fluctuation limit for transfers with a guaranteed rate. If the rate changes by 2% or more during the guaranteed rate period, we will still allow you to make the transfer using the current rate. The non-refundable fee will not be refunded in this case.

Rates are not held over weekends due to higher exchange rates.

7. Place any transfer reference that will be visible to the recipient, then add the rest of the reporting fields (category, budget, other reporting fields) on your payment

8. Review the transfer details, and if all good, click "Confirm" and the transfer will be initiated.

Notes:

If you are initiating a SWIFT transfer and your business name is longer than 35 characters, please include the full business name in the Payment Reference field. Field 50 (Payer Name) of the MT103 has an inbuilt limitation by SWIFT of 35 characters.

Our payment partner will select the intermediary bank for your USD account SWIFT transfers; you can't choose a specific one.

If you're experiencing an error message when sending transfers, you can find further details here.

What name will be displayed as the sender of the transfer?

For EUR & GBP local transfers, the beneficiary will see your company name as the sender of the funds.

For other supported currency local transfers, the beneficiary will see Currencycloud or Currencycloud payment partners' names as the sender of the transfer.

For SWIFT transfers, the beneficiary will see your company name as the sender.

Transfer Fee & Rate

Local Transfer

Sending these supported currencies locally to their home country is FREE!

SWIFT Transfer

USD to USD Transfers sent via SWIFT (within or outside the US) cost USD 15.

FX transfers sent via SWIFT will be converted at the best rates and cost USD 15.

Please note that there may be intermediary bank fees deducted from the sent amount, which can range from $7 to $60. There are 2 types of SWIFT Intermediary fee types you can choose:

Shared Charges (SHA)

You pay for the Remitting bank's charges (Aspire). Your recipient bears the charges of the Intermediary banks and their bank, which will be deducted from the remittance amount. Your recipient will receive the remaining balance. This is the most common type of charge, where each party bears their respective charges.

OUR charges (OUR)

Charges are borne by the Remitter (you). You bear the Remitting bank's charges and all the Intermediary banks' charges. You can fix the amount the recipient will receive by paying a small fee upfront.

To guarantee that the recipient receives the full amount, you can cover the intermediary SWIFT Fee, which costs USD 30. Just toggle the button on the transfer screen to fix the amount. This will secure that your recipient will receive the total amount and pay no fees.

This is the option you should select when you are paying someone a salary or an invoice, and they must receive the exact amount.

Notes:

Beneficiary bank charges, if any, are still deducted from the amount sent.

For refunded SWIFT transfers, the returned amount may be less than the original amount due to:

Intermediary fees charged by banks during the return of funds; or

Double conversion if the transfer involves foreign exchange.

Transfer Timeframe

Transfer Type | Timeframe* |

Local Transfer | 1-2 business days |

SWIFT Transfer | 3-5 business days |

Notes: *Please note that all transfers go through compliance checks by our team or partners, which might cause delays in receiving the funds. Our team might email Admin and Finance users for additional details or documents needed to process your transfer. While we strive to complete these reviews quickly, we can't provide an exact timeline for when you will receive the funds, as weekends, public holidays, and banking hours might also affect the timing. We appreciate your understanding and patience regarding any potential delays.

Questions? Chat with us by clicking on the messenger icon at the bottom right of the screen once you are logged in.